Unfortunately, the alerts that you have set up now will not transfer. You will need to set up your alerts again once you're in the new digital banking platform.

-1.png?width=1107&height=623&name=2024%20Digital%20Banking%20Campaign%20(2)-1.png)

-1.png?width=313&height=125&name=1%20(1)-1.png)

Visit the Apple Store if you have an iPhone or the Google Play Store if you have an Android device.

.png?width=331&height=111&name=2%20(1).png)

Enter your current Login ID. Enter your temporary password, your last name, and the last 4-digits of your Social Security Number. You will receive a secure access code. You will then choose your new password.

Agree to terms and conditions, then register your trusted device.

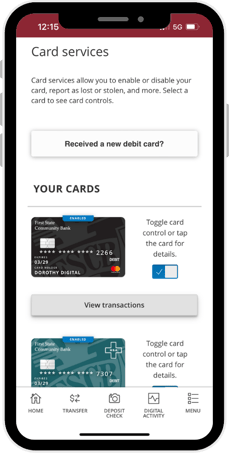

Easily control and monitor when, where, and how your debit card is used, all with the press of a button.

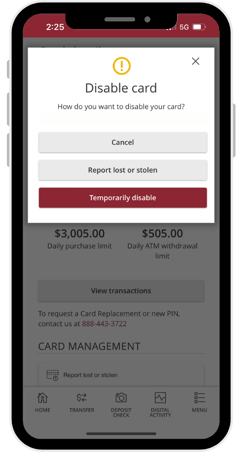

With added security, you can enjoy peace of mind knowing that with just a few clicks, you can temporarily deactivate your card to prevent unauthorized use in case it’s lost or stolen, ensuring your funds are protected.

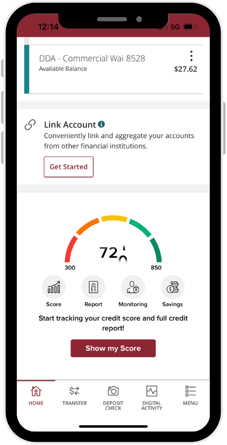

Get FREE Access to your Credit Score to understand your current position and proactively spot potential trouble so you have a greater chance of getting better interest rates, qualifying for loans, and confidently achieving your financial goals.

Whether you’re building a nest egg for a down payment on a new home or saving to cover the next major car repair, you can set goals and create financial habits to support them right within your digital banking. Create custom financial targets and start working toward them now by setting up automatic savings transfers, all while keeping an eye on your progress.

-4.png?width=231&height=453&name=2024%20Digital%20Banking%20Campaign%20(2)-4.png)

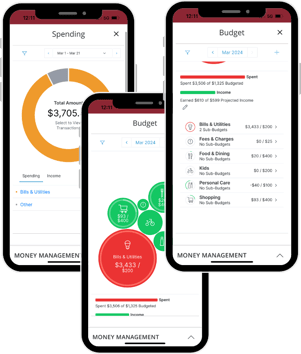

Feel like you’re being pulled in different directions: cash coming into your account, bills to pay each month, charges on your credit card, banking with multiple financial institutions, and funds you’re investing for the future. Navigate your everyday finances with our new Money Management Tools Feature.

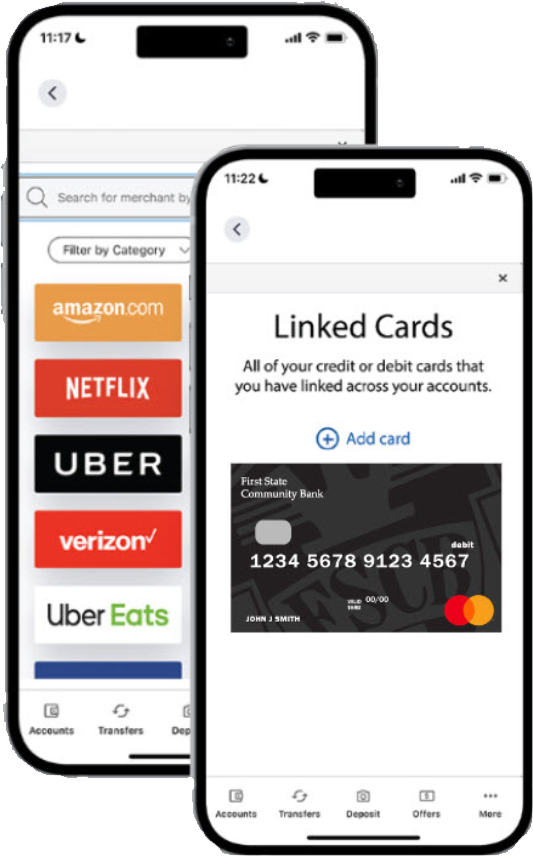

No one likes the headache of updating payment methods on digital subscriptions like Amazon, Hulu, Netflix, Spotify, Pandora, Netflix. But what if you can do it with just one click? With First State's digital banking you can automatically apply a new debit card across your favorite subscriptions. Gone are the days that your subscriptions payments get missed if your card would get lost, stolen or replaced. Sit back, watch your favorite show or listen to your playlist, and we'll do the updating!

Efficiently manage your money by linking external accounts (Domestic, U.S. banks only). Linking external accounts allows seamless fund transfers.

Automatically save money while you shop! You can round up the change on our debit card transactions and deposit the money into a checking or savings account through our Pocket Change program. Enrollment is quick and easy through your digital banking.

Stay on top of your accounts and what’s important through our customized text or push notification alerts. Check out our alert options:

Upgraded protection to keep your account information secured. You’ll now see:

Business Admin Users will have the capability to add additional users and assign specific permissions. Each user will have their own access for a smooth digital banking experience.

![]()

Comprehensive insights, with real-time data and analytics, empowering you to make informed decisions for your business.

![]()

With ACH origination you can send and receive money, which includes payroll, membership fees, and paying bills. Send domestic and international Wires easily and securely.

Protect your accounts and manage risk by validating your check and ACH information before clearing your accounts. Positive Pay actively monitors checks presented on your account, which can be activated through your digital banking platform.

Unfortunately, the alerts that you have set up now will not transfer. You will need to set up your alerts again once you're in the new digital banking platform.

Great news! The digital conversion doesn't affect your accounts that are currently enrolled in pocket change, so there is nothing to do there! Also, just to let you know if you ever need to enroll more accounts in pocket change, you will be able to do that in your digital banking!

We're here to assist you every step of the way. You can always come visit us during banking hours or you can also reach out to our customer care center by phone, where our dedicated team is available to assist you. Additionally, if it's more convenient for you, you can use the secure messages feature within your digital banking platform to communicate with us directly.

As an additional security measure, you must verify your identity when logging into your account for the first time from a new device with a 6-digit Secure Access Code (SAC). Using your information on file with us, you will choose to receive a text, email, or phone call to receive your 6-digit code. If your contact information is not up to date, then you will not be able to receive the SAC code to log in.

Any transfer (one-time or recurring) that is scheduled to process after May 7 that was set up in your current environment, will process as intended. It is encouraged to review your transfers after May 7 to verify they converted as you intended.

There will be a “no maintenance” to any digital banking accounts from May 1 - May 6. Account maintenance can include things like creating recurring transfers, changing your recurring transfers, renaming your accounts, and changing any contact information. Any maintenance performed to your digital banking accounts during this time will not convert to your digital banking environment. We highly recommend that “no maintenance” take place on your accounts in digital banking from May 1 - May 6.

During this time period, your old online banking (the current one now) will still be active to complete transactional activities like making a transfer, checking balances, and mobile deposits.

Yes, after you first log in to your mobile phone, you will be allowed to set up your new Face ID and other biometric options.

As you make a payment through the Loan Payment option under the Transfers & Payments menu, you will have the option to make this a recurring payment.

We are converting the past 18 months of electronic statements, and notices will be available immediately after conversion. Moving forward, customers will always have a maximum of 18 months of eStatements and notices that can be retrieved in digital banking.

© 2025 FSCB - All rights reserved Bank NMLS 412605 Web SecurityPrivacy Policy Digital Banking Privacy Policy

First State Insurance Agency and First State Financial Management products are: not a deposit, not FDIC insured, not insured by any government agency, not bank guaranteed and may decrease in value.